US pauses reciprocal traffis on electronics, Chin...

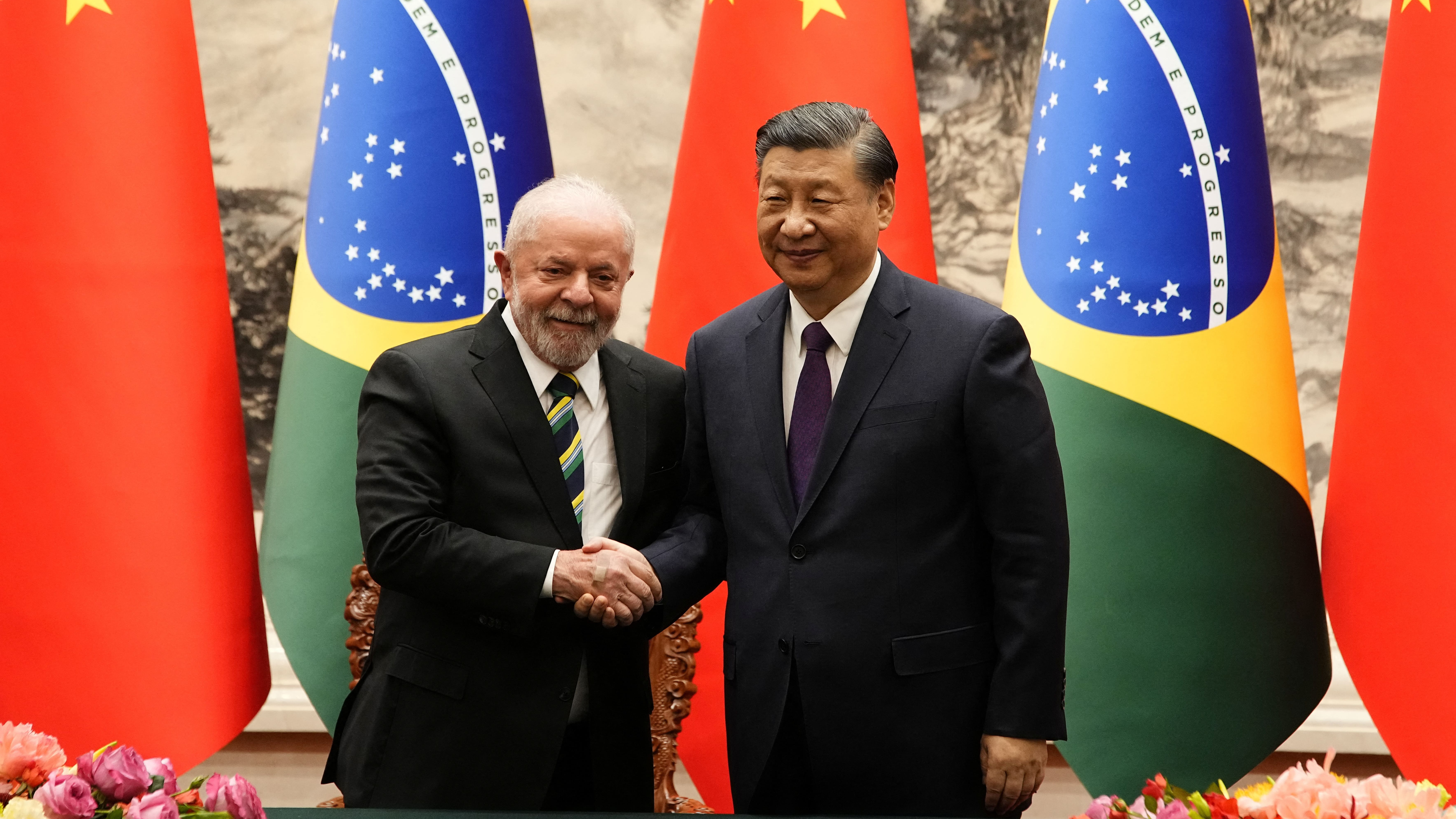

US pauses reciprocal traffis on electronics, China has huge impact, US gave India a key window to boost smartphone export From China+1 to Brazil India? The Smartphone Supply Chain Shuffle Could Be Coming For over a decade, the global smartphone supply chain has revolved around China. But growing geopolitical tensions, rising labor costs, and a push for diversification are prompting tech giants to look beyond their long-time manufacturing hub. The latest strategy on the horizon? A pivot from "China+1" to "Brazil India." The Fall of "China+1" "China+1" was once the go-to strategy for companies hoping to minimize their dependence on a single country. Vietnam, Thailand, and Malaysia were popular alternatives. However, this approach has shown its limits, especially during COVID-era disruptions and recent trade skirmishes. The lingering U.S.-China tech cold war, coupled with Beijing’s increasingly strict regulations, has forced tech firms to look for deeper, long-term manufacturing partners. Why Brazil and India? 1. Strategic Scale India already plays a major role in smartphone assembly, with Apple and Samsung making significant investments. Foxconn and Pegatron, key Apple suppliers, are expanding their India operations aggressively. Meanwhile, Brazil—though often overlooked—is becoming more appealing thanks to its established electronics sector and favorable trade policies within Latin America. 2. Cost-Effective Labor & Growing Demand Both Brazil and India offer lower labor costs compared to China and are home to massive domestic markets. For smartphone manufacturers, building close to the customer not only cuts logistics costs but also helps brands tailor products to local tastes. 3. Government Incentives India’s PLI (Production Linked Incentive) scheme has already lured several manufacturers. Brazil, too, is stepping up with tax incentives and relaxed import duties on components to attract more tech giants. The Shifting Landscape Apple has already begun manufacturing the latest iPhone models in India. Reports suggest that by 2027, a quarter of all iPhones could be made in India. Samsung, meanwhile, is eyeing deeper collaborations in Brazil as part of its Latin America growth strategy. Smaller brands like Xiaomi, Realme, and Motorola are also reevaluating their supply chain blueprints to include these two emerging players. Challenges Ahead Despite the optimism, the transition won’t be without hurdles. Infrastructure bottlenecks, bureaucracy, and inconsistent policies still plague both countries. Logistics in Brazil remain a challenge, and India continues to struggle with power supply issues and land acquisition delays. Moreover, China’s deeply entrenched component ecosystem—especially for chips, batteries, and screens—will take years to replicate elsewhere. Conclusion The smartphone supply chain is undergoing a seismic shift. While China will remain a key player for years, the rise of Brazil and India signals a new chapter in tech manufacturing—one that’s more geographically diverse, politically savvy, and resilient. For companies betting on the future, spreading risk and building capacity across continents may no longer be optional—it’s strategic survival. _ ANSHIKA VERMA

Keywords

Subscribe for latest offers & updates

We hate spam too.